Pages

الأربعاء، 19 أكتوبر 2011

الأحد، 16 أكتوبر 2011

الجمعة، 7 أكتوبر 2011

Monday Night at Denny's

مرسلة بواسطة

إيهاب محروس

5

Monday Night at Denny's

fromSmartMoney University

from

This final disaster story doesn't involve investing in stocks. It has to do with not investing -- letting your savings sit in the bank or in one of those "safe" money-market accounts.

Let's set the scene. You're 35 years old, making a good salary, and putting away about $5,000 a year for retirement. Stocks have never interested you -- they've always sort of given you the creeps -- and you're convinced the bull market is going to come to a screeching halt, anyway. Better to put your money in a conservative investment.

Flash forward 25 years and suddenly you're on retirement's doorstep. The money you've socked away at 6% a year totals almost $300,000. Will it last another 20 years or so? Let's see...after 25 years of 3% inflation, $300,000 really buys only $192,000 worth of greens fees and tickets to see the grandchildren. And when you take out what you owe in taxes, your total dwindles down to about $138,000.

You'd better hope your kids are generous.

The fact is, unless your idea of happiness is the Monday night seniors' buffet at Denny's, you'd better get aggressive when you're young. That's when you have enough time to absorb the periodic short-term losses that inevitably accompany stock investing. At 11% annually -- the historical return for the S&P 500 -- your $5,000 a year would have preserved your $300,000, given the same assumptions. And even that wouldn't be enough. You should be saving more than that each year.

Of course, proper asset allocation would have dialed your exposure to stocks back as you got closer to your chosen retirement age. But even so, you'd still be far ahead of where you were if you'd stuck with the money-markets. The stock market may be risky, but avoiding it altogether may be riskier still.

The Wall Street Water Torture

مرسلة بواسطة

إيهاب محروس

4

The Wall Street Water Torture

fromSmartMoney University

from

Every day, for 10 full years, you grab the paper to track your portfolio of blue chips, hoping for something to cheer about. But day in and day out, you face the same monotonous drip of endless bad news.

Blue-chip stocks have led the most recent bull market, as companies like General Electric, Wal-Mart and IBM exploded for huge gains. But that wasn't always the case. Back in the 1970s, the bad economic news never seemed to stop coming, and the biggest, best-known stocks suffered through five bear markets from 1966 to 1982.

During the 1970s, people who owned stocks dropped from 50% to 20% of the general U.S.

Fortunately, small-company stocks came to the rescue. By 1975, after the worst of the '70s bear markets had ended, profits started to take off for a new breed of young, nimble corporations -- especially those involved in computers. While big companies languished, the stocks of small ones soared almost 131%, adjusted for inflation.

The moral: Just as smart investors never bet the bank on a single stock, they rarely concentrate their holdings in one narrow band of the market. Instead, they spread their assets across a diversified portfolio of big, small and international stocks, not to mention bonds and stable money-market investments.

This strategy, known as asset allocation, takes advantage of the market's one certainty -- that you never really know what's going to perform well and when. While small stocks saved the day in the late 1970s, they've lagged badly at the tail end of this bull market. But if you're properly diversified across the two groups, one will buoy you while the other tries to drag you down.

Dirty, Rotten Scoundrels

مرسلة بواسطة

إيهاب محروس

3

Dirty, Rotten Scoundrels

fromSmartMoney University

from

Don't be rude. There's nothing wrong with listening to your brother-in-law when he starts spouting on about his latest "discovery" in the stock market. But before you plunk down any of your hard-earned money on one of his "can't fail" wonders, consider the story of Canadian mining company Bre-X Minerals.

Stocks aren't always what they seem. When you set out to analyze one, much of the information -- for better or worse -- comes from the company itself. Sure, the financial statements are audited. And there are plenty of laws against fraud. But that's scant protection against a management team bent on lying to you outright.

A few years ago, Bre-X became the hottest stock on the market after company assayers salted a mining property in Indonesia

If Bre-X had been the only stock you'd owned then, you'd be thinking of jumping down a mine shaft yourself right now. But savvy investors never put all their money in a single investment. Instead, they diversify their holdings, investing in at least 10, usually 20, different stocks. Mutual funds typically invest in anywhere from 15 to several hundred companies at once.

What our demonstration shows is that if you'd limited your initial investment in Bre-X to 5% or less of your holdings, you would have been fine. Better than fine, in fact. Assuming your other 19 stocks earned an average return, you would have ended up with a 41% gain after two years. No matter how hot the stock, it always has the potential to blow up. The only way to protect yourself is to diversify, diversify, diversify

The Waiting Game

مرسلة بواسطة

إيهاب محروس

2

The Waiting Game

fromSmartMoney University

from

Larry Ellison, the brash, billionaire chairman of Oracle, has two overriding passions: Asian culture and beating Microsoft. The one led him to establish vast

In August 1997, however, Ellison's twin passions caught up with him.

From 1990 through the spring of 1996, Oracle stock soared a remarkable 750%. Had you jumped into the company's shares when they dipped that April to around 13 (adjusted for splits), your investment would have more than doubled over the next 16 months to $27 a share.

But then the bottom fell out. In late August of that year, a currency crisis in Thailand

The next four months were pure hell for Oracle investors. The stock plunged 54% to a low of 12 1/2 in early January. For most of 1998, Asia 's economies continued to muddle along and countless Oracle investors jumped ship. You might have been tempted to sell, too -- all of your gains from that April 1996 investment would have evaporated.

But if you had sold, you would have lived to regret it. By the time the summer of 1998 rolled around, Asia began to stabilize and sales data were proving that Oracle's database customers weren't defecting to Microsoft's NT product in any large numbers. It turned out NT software wasn't powerful or reliable enough for really big database users. Oracle began to post solid earnings numbers, which lit a new fire under investors. From late August until February of 1999, the stock rocketed 200% to more than $37 a share.

Sometimes patience is your best defense against market volatility. If you've done your homework and believe in your company's management, you should have faith that they can work through the inevitable rough patches that any business encounters. If something had changed fundamentally for Oracle -- if Microsoft's NT really was gaining, for instance -- it might have been time to bail. But in this case, Wall Street simply overreacted and those with a short-term perspective lost plenty of money.

Black Monday

مرسلة بواسطة

إيهاب محروس

The Stock Market Chamber of Horrors

Be strong. You're about to take an interactive tour of the more gruesome side of investing. But it's not all bad news. Coupled with each of these disasters is a prescription for avoidance—a strategy for defending yourself and maximizing your rewards. Don't miss this special—and highly educational—series.

1

Black Monday

fromSmartMoney University

from

Black Monday made a lot of people feel that way. It sent a wave of dread through a nation drunk on its own prosperity. Fueled by Reaganomics and an easy-money culture, stocks had soared more than 225% between January of 1980 and late summer of 1987. When they plunged 30% in a matter of weeks -- most of it on that ugly 508-point day -- the nation stood still in a collective state of shock. Not since 1929 had Wall Street looked so instantly vulnerable.

A market free-fall is about the scariest thing imaginable for anyone who has put faith in stocks. But that has more to do with fear of the unknown than actual financial damage. It's true that if you had invested all your money near the market's peak in 1987 and held on through the crash, you wouldn't have recovered your losses until August 1989. But the fact is, most people don't invest that way. They tend to put money to work a little at a time, laying aside a part of their paycheck at regular intervals.

Suppose, for instance, that you had invested $10,000 in equal monthly increments of $385 from July 1987 until August 1989. Although you would have lost what you had accumulated by September 1987, your $385 a month would be buying stock that was dirt cheap in late October. As stocks began to rally, you'd be getting the full benefit of the recovery. And when all was said and done, you'd be sitting on almost $12,400.

Investing a little at a time is a strategy known commonly as "dollar-cost averaging." It doesn't shield what you already have invested from a market crash, but it does let you take advantage of the fact that stocks become cheaper as the market declines. Because the amount you invest remains constant, you are able to buy more shares of a stock or mutual fund when the price is low and fewer shares as the price rises.

Investing on dips -- or crashes -- is the hallmark of the experienced investor. It may take nerves of steel at first, but experience will teach you that the market rewards those who buy low and sell high. The worst thing, of course, is to do what most people find completely intuitive when the market tanks -- sell at the first available opportunity. The best advice for Julie Ianotti would have been: "Hold on tight."

السبت، 1 أكتوبر 2011

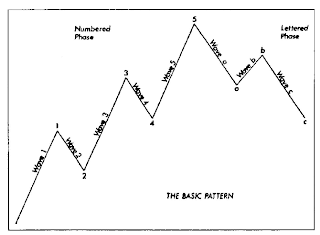

إليوت ونظرية الأمواج 9

مرسلة بواسطة

إيهاب محروس

أرقام فيبوناتشي Fibonacci Numbers

أرقام فيبوناتشي هي عبارة عن متسلسلة من الأرقام علي الشكل التالي

1,1,2,3,5,8,13,21,34,55,89,144,………….

ملاحظات حول أرقام المتسلسلة

1- مجموع كل رقمين يعطي الرقم التالي.

2- نسبة أي رقم بالنسبة للرقم التالي له تساوي نسبة ثابتة تقريباً.618

باستثناء أول أربع أرقام.

3- نسبة أي رقم بالنسبة للرقم السابق له نسبة ثابته تقريباً 1.618 .

4- نسبة أي رقم للرقم الذي يلي التالي له مثل (34 ,13) تساوي تقريبا نسبة ثابتة 2.618 والمعكوس لها .382

علاقة أرقام فيبوناتشي وموجات إليوت

1- موجة واحدة من الموجات المحفزة(Impulse wave) تكون ممتدة والاثنان الباقيان يكونان متساويان في الزمن والكبر(أو الطول).

2- أقل سعر مستهدف لموجة 3 يمكن الحصول عليه عن طريق ضرب

طول موجة 1 في 1.618 وجمع الناتج علي قيمة القاع 2.

3- قمة الموجة 5 يمكن الحصول عليها عن طريق ضرب طول الموجة

1 ×(2×1.618 ) وجمع الناتج علي قمة موجة 1 للحصول علي

أعلي قيمة محتملة و إضافاتها علي قاع موجة 1 للحصول علي أقل

قيمة محتملة.

4- في حالة أن الموجة 1 و 3 متساويين في الطول فإن موجة 5

متوقع لها أن تمتد ويمكن الحصول علي القمة المتوقعة لها عن

طريق قياس المسافة من قاع 1 إلي قمة 3 وضرب الناتج في

1.618 وإضافة الناتج إلي قاع الموجة 4 .

5- في الموجات التصحيحية Zigzag في الشكل القياسي (normal)

5-3-5 موجة C غالباً ما تكون في طول الموجة A.

6- طريقة أخري لحساب الطول الممكن للموجة C تكون بضرب

الرقم .618 في طول الموجة A وطرح الناتج من قاع الموجة B .

7- في حالة الموجة التصحيحية FLAT التي علي شكل 3-3-5 حيث

الموجة B تصل أو تتجاوز قمة الموجة A تكون الموجة C حوالي

1.618 من طول الموجة A .

8- في المثلث المتماثل (Symmetrical Triangle) كل الموجات

التعاقبية تترتبط بالموجة السابقة لها بنسبة (.6180) .

هناك فروق بين موجات إليوت في الأسواق المختلفة

1- مثلاً الموجة 3 تكون هي الموجة الممتدة في سوق الاسهم أما في سوق البضائع أو السلع فإنه غالباً ما تكون موجة 5 هي الممتدة.

2- موجة 4 لا يمكن ان تتداخل مع موجة 1 في سوق الاسهم وليس الأمر كذلك في سوق البضائع.

أرقام فيبوناتشي هي عبارة عن متسلسلة من الأرقام علي الشكل التالي

1,1,2,3,5,8,13,21,34,55,89,144,………….

ملاحظات حول أرقام المتسلسلة

1- مجموع كل رقمين يعطي الرقم التالي.

2- نسبة أي رقم بالنسبة للرقم التالي له تساوي نسبة ثابتة تقريباً.618

باستثناء أول أربع أرقام.

3- نسبة أي رقم بالنسبة للرقم السابق له نسبة ثابته تقريباً 1.618 .

4- نسبة أي رقم للرقم الذي يلي التالي له مثل (34 ,13) تساوي تقريبا نسبة ثابتة 2.618 والمعكوس لها .382

علاقة أرقام فيبوناتشي وموجات إليوت

1- موجة واحدة من الموجات المحفزة(Impulse wave) تكون ممتدة والاثنان الباقيان يكونان متساويان في الزمن والكبر(أو الطول).

2- أقل سعر مستهدف لموجة 3 يمكن الحصول عليه عن طريق ضرب

طول موجة 1 في 1.618 وجمع الناتج علي قيمة القاع 2.

3- قمة الموجة 5 يمكن الحصول عليها عن طريق ضرب طول الموجة

1 ×(2×1.618 ) وجمع الناتج علي قمة موجة 1 للحصول علي

أعلي قيمة محتملة و إضافاتها علي قاع موجة 1 للحصول علي أقل

قيمة محتملة.

4- في حالة أن الموجة 1 و 3 متساويين في الطول فإن موجة 5

متوقع لها أن تمتد ويمكن الحصول علي القمة المتوقعة لها عن

طريق قياس المسافة من قاع 1 إلي قمة 3 وضرب الناتج في

1.618 وإضافة الناتج إلي قاع الموجة 4 .

5- في الموجات التصحيحية Zigzag في الشكل القياسي (normal)

5-3-5 موجة C غالباً ما تكون في طول الموجة A.

6- طريقة أخري لحساب الطول الممكن للموجة C تكون بضرب

الرقم .618 في طول الموجة A وطرح الناتج من قاع الموجة B .

7- في حالة الموجة التصحيحية FLAT التي علي شكل 3-3-5 حيث

الموجة B تصل أو تتجاوز قمة الموجة A تكون الموجة C حوالي

1.618 من طول الموجة A .

8- في المثلث المتماثل (Symmetrical Triangle) كل الموجات

التعاقبية تترتبط بالموجة السابقة لها بنسبة (.6180) .

هناك فروق بين موجات إليوت في الأسواق المختلفة

1- مثلاً الموجة 3 تكون هي الموجة الممتدة في سوق الاسهم أما في سوق البضائع أو السلع فإنه غالباً ما تكون موجة 5 هي الممتدة.

2- موجة 4 لا يمكن ان تتداخل مع موجة 1 في سوق الاسهم وليس الأمر كذلك في سوق البضائع.